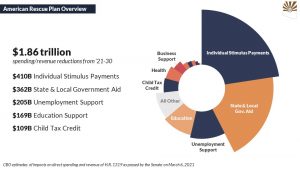

American Rescue Plan Act of 2021

U.S. Department of the Treasury – American Rescue Plan Act Guidance:

- Coronavirus State and Local Fiscal Recovery Fund

- Interim Final Rule – Coronavirus State and Local Fiscal Recovery Funds

- Fiscal Recovery Funds Quick Reference Guide

National Association of Counties (NACo) – County Response Efforts & Priorities Page

Federal Coronavirus (COVID-19) Webpage

- 30 Days to Slow the Spread

- Guidelines for Opening Up America Again(Phased Approach – States & Regions)

June 5, 2020

- President Trump signed the bipartisan Paycheck Protection Program Flexibility Act of 2020 ( 7010)

- The bill outlines how the forgiveness of loans extended to small businesses under the Paycheck Protection Programin response to COVID-19 are implemented.

- Sets up a minimum maturity of five years for a paycheck protection loan for any amounts remaining after forgiveness, extends the timeframe the recipient may use the funds for forgivable expenses, and increases the amount of non-payroll portion of a forgivable amount from 25% up to 40%.

- Provides the employer additional time to rehire employees or eliminate the reduction in employees due to the inability to rehire former employees, find similarly qualified employees, or for the inability to return to the same level of business activity due to compliance with federal requirements or guidance related to COVID-19.

- Extends the deferral period for payments until after they receive compensation for the forgivable amount, or for 10 months for loans that do not have a forgivable amount.

April 18, 2020

- President Trump signed an Executive Orderfor additional economic support for U.S. businesses, including U.S. manufacturer supply chains during the COVID-19 pandemic. Allowing importers that have faced financial hardship due to COVID-19 to defer the payment of some cuties, taxes and fees for 90 days.

- The Treasury Department and the U.S. Customers and Boarder Protectionissued a joint Temporary Final Rule (Temporary Rule).

March 27, 2020

- President signed the H.R. 748 the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) Public Law No: 115-136. The CARES Act provides over $2 trillion dollars in economic relief to state and local government, businesses, and individuals to help address the impact of the COVID-19 pandemic.

- The NACo analysis of the legislation can be found here.

A few key provisions are as follows:

Coronavirus Relief Fund

- Provides $150 billion in aid to states, tribal governments, territories and local governments with populations of over 500,000 people to address necessary expenditures incurred due to the COVID-19 public health emergency.

- NACo is asking Congress and the U.S. Treasury Department (Treasury) for clarification on details of this fund—including eligibility for counties with populations under 500,000. The Treasury will issue rules/guidance on how the funds can be requested.

- Arizona’s share is expected to be approximately $2.8 billion dollars, excluding any additional funds from the $8 billion allocated to tribal governments across the United States.

Bond Purchases

- Creates a $500 billion Economic Stabilization Fund that authorizes the U.S. Treasury to purchase obligations of states, local governments and political subdivisions of them, to cover losses incurred as a result of COVID-19.

Health Care & Hospital Funding

- $100 billion in funding for local hospitals to address medical surge capacity issues and offset the cost of increased healthcare-related expenses and lost revenue. Eligible health care providers include public entities, Medicare or Medicaid enrolled suppliers or providers and other health care facilities.

- Delays statutory cuts to Medicaid Disproportionate Share Hospital (DSH) payments until FY 2021 to help hospitals, including eligible county-owned hospitals, serving indigent and underinsured people make up for revenue losses and continue to provide high-quality care to all patients especially during this time of crisis.

- $3.5 billion in additional funding for the Child Care Development Block Grant to provide childcare assistance to health care sector employees, emergency responders, sanitation workers and other workers deemed essential during the response to the COVID-19.

Unemployment Insurance

- Provides new temporary Pandemic Unemployment Assistance through December 31, 2020, to provide unemployment benefits for those individuals that lose a job as a direct result of COVID-19 and are not eligible for other unemployment compensation such as self-employed, independent contractors, and those with limited work history.

- Includes an additional $600 per week payment to each recipient of Unemployment Insurance or Pandemic Unemployment Assistance for up to four months.

- Provides emergency unemployment relief for governmental entities and nonprofit organizations

- Provides for flexibility on a merit basis for temporary staff, rehiring retirees or former employees on a non-competitive basis, and other temporary actions to quickly process applications and claims

Small Businesses

- $10 billion for the SBA Emergency Economic Injury Disaster Loans grants to help struggling small businesses cover expenses.

- $17 billion in additional funding to subsidies to make six months of principal and interest payments for all SBA backed business loans.

- $265 million for SBA entrepreneurial development programs to support small business centers, women’s business centers for technical assistance and resource partner associations to provide online information and training.

- $10 million for the Minority Business Development Agency within the Department of Commerce to provide grants to Minority Business Centers and Minority Chambers of Commerce for counseling, training, and education on federal resources and business response to COVID-19 for small businesses.

Food & Supply Chain Assistance

- $16 billion to replenish the Strategic National Stockpile of pharmaceuticals, personal protective equipment.

- $1 billion for the Defense Production Act to bolster domestic supply chains.

- $15.5 billion in additional funding for the Supplemental Nutrition Assistance Program (SNAP) to support states and localities in deploying program flexibility and meeting the growing need for food assistance as a result of COVID-19.

- $955 million for the Administration for Community Living (ACL) to assist local Area Agencies on Aging in providing services to seniors and their caregivers, including home-based support, senior nutrition programs, and elder protection.

- $88 million in additional funding for food systems and safety including $55 million in additional funding for animal and plant health inspections and an additional $33 million for the Food and Safety Inspection Service.

March 18, 2020

- President signed the Families First Coronavirus Response Act (H.R. 6201) Public Law No: 116-127appropriating over $100 billion in measures to address the impacts of the pandemic.

- Testing for COVID-19 at no cost for individuals with private insurance, on a government plan or the uninsured

- Increased federal match rate (FMAP) for Medicaid programs (including ALTCS) for the duration of the emergency

- $1 billion for various food assistance programs

- $1 billion for emergency grants to states for unemployment insurance benefits

- Establishes a Public Health Emergency Leave program

- Requires employers with fewer than 500 employees to provide 2 weeks of paid sick leave. Includes leave to care for a minor child whose school or childcare facility is closed.

- NACo Summary

March 13, 2020

- President Trump Issued Two Emergency Declarations Under the Safford Actand National Emergencies Act

- Activated the National Response Framework and access to the Disaster Relief Fund Public Assistancegrants issued by FEMA for measures taken before, during and immediately after the incident to save lives

- Taken at the direction or guidance of public health officials

- Include activation of State Emergency Operations Centers (EOC), National Guard costs, law enforcement and other emergency protective measures necessary to protect public health and safety

- Does not duplicate assistance provided by other federal agencies

- FEMA assistance will be provided at 75 percent Federal cost share

- Requires execution of FEMA-State/Tribal/Territory Agreement – States will not need to request separate emergency declarations under this declaration

March 6, 2020

- President signed the $8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (H.R. 6074) Public Law No: 116-123in response to the COVID-19 pandemic

- $2.2 billion to the CDC for prevention, preparation and response to COVID-19:

- $950 million for grants to support states, counties, cities and tribes

- $570 million has already been distributed to public health emergency preparedness recipients (primary states)

- $3.0 billion for research and development of COVID-19 vaccines and diagnostics tools

- $100 million for Community Health Centers

- $3.1 billion for the Public Health and Social Services Emergency Fund

- NACo Summary